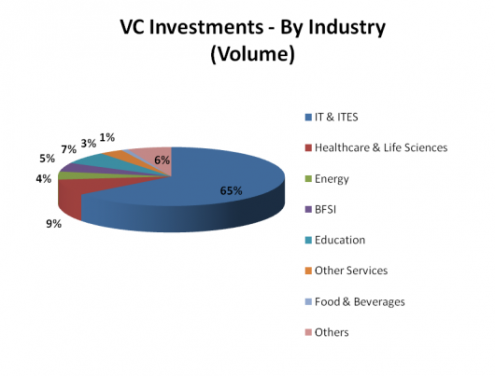

Venture capital firms invested about $762 million in over 206 deals in India during the twelve months ended December 2012, according to a study by Venture Intelligence. Investment activity declined by 7.2% as compared to 2011, which had witnessed $1,094 million being invested across 222 deals. The amount invested declined by 30% suggesting a marked preference for smaller ticket investments. VCs made 133 investments worth about $381 million in Information Technology and IT-Enabled services (IT & ITES). IT & ITES accounted for 65% of the investments made in 2012 and accounted for 50% in value terms. While the volume of investments in IT & ITES climbed 8% in 2012 as compared to 2011, IT & ITES saw a decline of 32% in the value of VC investments year-on-year in 2012. The research company claims that the decline is due to the fact that formerly VC-backed IT start-ups graduated to receive significant sized PE rounds during 2012. Other sectors like healthcare & life sciences industry attracted 18 VC investments worth $98 million during the year. Education industry attracted 14 investments worth $53 million, Financial services and Energy industry with 10 investments worth $55 million and 9 investments worth $62 million respectively. Investments by region: Companies based in South India accounted for 45% of all VC investments (56% by value) during 2012, Western India accounted for 25% (12% by value) and North India accounted for 23% of the investments in 2012 (22% by value). Companies headquartered in Bangalore accounted for the most number of VC investments with 62 investments, followed by National…