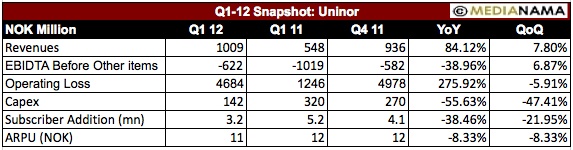

Uninor has said that the recent recommendation from the TRAI on spectrum auction, following the Supreme Court’s ruling to revoke all licences issued in 2008, has severe negative impact on both the telecom industry in India and Uninor, and that it would be impossible for Telenor to participate in the fresh auctions, if the recommendations were approved. The company did not include Uninor in its financial guidance for 2012 for the Group. Based on the high uncertainty of the terms and conditions for the re-allocation of licences, Telenor has recognised an impairment loss of NOK 3.9 billion in the first quarter of 2012. Telenor had recognised an impairment loss of NOK 4.1 billion in the last quarter, following the Court verdict. The company has urged the Indian government to clarify a sound framework for the industry. With a net subscriber growth of 3.2 million during the quarter ended 31st March 2012, the operator has 31.5 million subscribers in the Indian market. Uninor holds UAS licence to offer mobile services in the 22 telecom circles in India. It has rolled out in 21 circles and is commercially present in 13 circles. Uninor reported revenues of NOK 1009 million for the quarter ended March 31st 2012, a QoQ increase of 8% in local currency.Compared to the first quarter of 2011, revenues increased by 102%. The company’s revenue in the same quarter last year stood at NOK 548 million. It registered an EBITDA loss of NOK 622 million, lower than previous quarter, due to a positive effect from reversal of accruals related to energy costs…