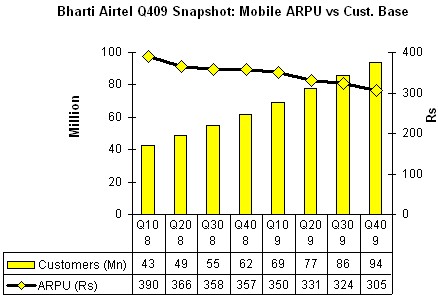

Bharti Airtel has reported a 4% rise in net profit at Rs. 2239 crores for the quarter ending 31st march 2009 and Rs. 8470 crores for the year, which is a 26% year on year rise. Consolidated revenues grew by 2% to Rs. 9825 crores in the quarter and to Rs. 36,962 crores for the year. They've announced at dividend of 20%, and a share split of 1:2. During the quarter, Airtel's mobile subscriber base grew from 85,651,000 subscribers to 93,923,000, up 10% quarter on quarter, and a 52% growth year on year from 61,985,000 at the end of last fiscal. With this increase in traffic, Airtel's ARPU has dropped from Rs 324 last quarter to Rs 305 and its average Minutes of Use has fallen by 20 minutes from last quarter. The growth in Telemedia services (DTH, Broadband and IPTV) hasn't still taken off, growing just 4% to 2,226,000 at the end of March 2009, growing just 4% since the end of December. Year on year, the company has recorded a 18% growth in Telemedia services revenues to Rs 33,517 million. Consolidated EBITDA margins for the quarter continued to stand at 41% at Rs 40,014 crores like previous quarters, but has decreased by 2% from last fiscal. The company said that it believes the EBITDA margin is sustainable. Quarter on quarter growth of EBITDA has dropped to 1% from 7% reported in Q3. Details: Release | Financials | Quaterly Report | Key Performance Indicators M-Banking Akhil Gupta, Deputy Group CEO…